Time for fun money?

Dear Dave,

I had about $12,000 in debt when my husband and I got married three years ago. Since that time, we’ve been given cash gifts from my parents from time to time, and we keep having discussions on how to use this kind of money when it is given to us. I’d like to put it toward paying off debt, but he would rather treat it as fun money. What are your thoughts on this, please?

Sara

Dear Sara,

If there’s something you need, and you agree on it together and choose to buy it as a couple, that’s cool. I’ve got no problem with that. But you guys are still just starting out, and you’ve got debts to pay. I’m sure your husband has a good heart, but I think it’s time for him to grow up a little and realize the importance of getting your financial house in order.

Did your parents have specific and reasonable thoughts on how they’d like you to use the money? If so, you should honor their intent. If not, then how it gets used is pretty much up to you guys. But in your situation, life’s not a birthday party when this kind of thing happens. You should be making mature, responsible decisions together regarding any money that comes into your household. It’s really no different than a paycheck. You take care of obligations and other important things first.

Adults waste money on play things and fun stuff just because it was handed to them by mom and dad. That’s how a 10-year-old behaves. Sit down with your husband, and explain how important it is that you guys start making better decisions with your money. If you two start working together, you could knock out this debt in a hurry!

—Dave

First, catch up!

Dear Dave,

I’ve had enough of living paycheck-to-paycheck. I’m going to start following your plan, but I have a question. Should I catch up on my past due bills before beginning Baby Step 1?

Simon

Dear Simon,

Go for it! You’re sick and tired of being sick and tired, and you’re going to get control of your money. I love it!

First, make sure you’re up to date with necessities—food, clothing, shelter, transportation, and utilities. Next, get current or make payment arrangements for any other types of debt you have, including credit cards.

You mentioned Baby Step 1, which is getting $1,000 in the bank for a beginner emergency fund. Baby Step 2, the debt snowball, comes next. Start paying off all debts, except for your home, from smallest to largest. Then, in Baby Step 3 you’ll save more and increase your emergency fund to a full three to six months of expenses.

Now, you can really start looking at the future. In Baby Step 4, you’ll start investing 15 percent of your household income for retirement. College funding for the kids, if there are any, is Baby Step 5, and Baby Step 6 is a milestone—pay off your house early!

But the real deal is Baby Step 7. This is when all your hard work, sacrifice, and smart financial decisions put you in a place where you can build wealth and give with outrageous generosity. At this point, you’re securing your family’s future and helping others in a big way!

—Dave

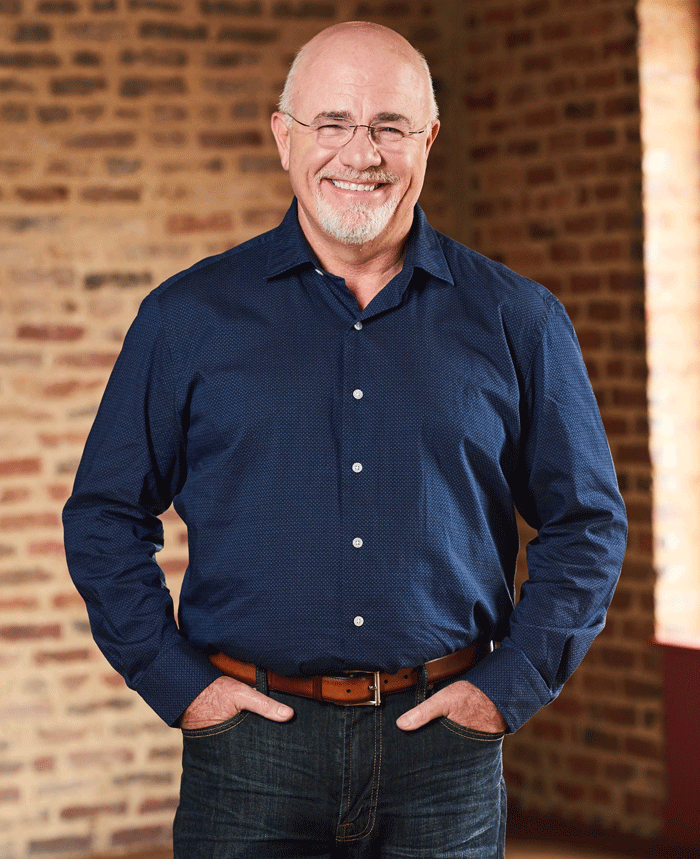

* Dave Ramsey is CEO of Ramsey Solutions. He has authored seven best-selling books, including The Total Money Makeover. The Dave Ramsey Show is heard by more than 16 million listeners each week on 600 radio stations and multiple digital platforms. Follow Dave on the web at daveramsey.com and on Twitter at @DaveRamsey.