Push the pause button

Dear Dave,

I’ve been following your plan, but recently I experienced a medical emergency. I’m about halfway through Baby Step 2 and paying off my debts using the debt snowball system. Considering the circumstances, should I stop doing the debt snowball for now?

Brooke

Dear Brooke,

That’s exactly what you should do. But make sure you’re only pressing the pause button on paying off debt. I’m talking about temporarily stopping the debt snowball, and making only minimum payments on all non-mortgage debt for now.

Cash is your umbrella when it rains, and you never know just long the rain will last. Even if you have great health insurance, you might end up paying a chunk out of pocket. That’s why it’s important to save up and have plenty on hand.

Things like this are often just a bump in the road, so don’t get discouraged. They can be expensive, and they’re part of life, but taking care of these kinds of issues doesn’t have to mean giving up on getting control of your finances. Emergency issues, especially a medical emergency, come first. Then, go back when things are better and pick up where you left off knocking out debt using the debt snowball system.

You can do this, Brooke. God bless you!

—Dave

You’re just not ready

Dear Dave,

My husband and I just bought a small business with cash. My sister let us live with her while we saved up the money for it, but things are starting to get a little cramped for everyone. The other day, my sister offered to co-sign on a house for us. Do you think this is a good idea?

Cari

Dear Cari,

Ok, so you just bought a business. I love your entrepreneurial spirit and the fact you saved up and paid for it with cash. But at this point, you don’t know if the business is going to be successful or not. On top of that, you told me you’d need a co-signer for a home. If you need a co-signer for anything, it means you’re not financially ready for that purchase.

I know you don’t want to hear this, but you guys need to just forget about buying a house for a while. If I were in your shoes, I’d find a decent, inexpensive place to rent, and spend two or three years getting the business up and running. Pay off any debt you have, while saving as much money as you can in the process.

I want you and your husband to have a nice house someday. But right now, it would be a burden instead of a blessing.

—Dave

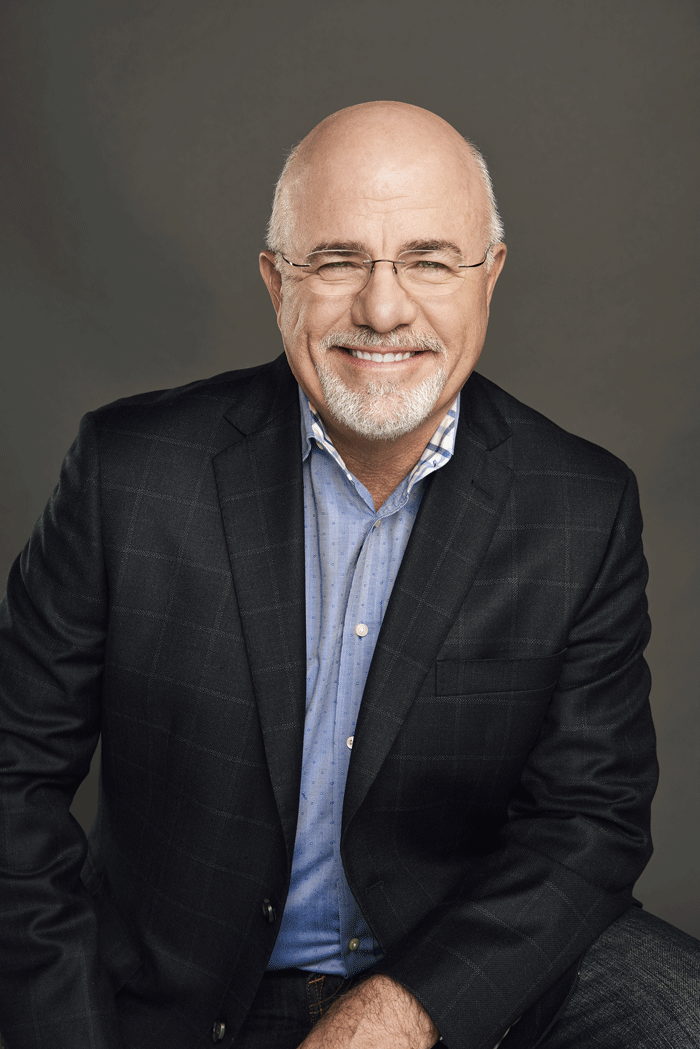

* Dave Ramseyis a seven-time #1 national best-selling author, personal finance expert, and host of The Dave Ramsey Show, heard by more than 16 million listeners each week. Hehas appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.